Borrowers

Unlock your home equity

If your bank has turned down your mortgage application or renewal, you’re not alone. Whether it’s due to being self-employed, new to Canada, having a less-than-perfect credit history, or an undischarged bankruptcy, it doesn’t mean you’re out of options for securing a first or second mortgage.

At RAM Mortgage Investment Corporation, we focus more on the value of your home than on traditional financial metrics. This approach allows us to say “yes” more often to your financing needs. For nearly 50 years, MICs have been offering borrowers well-regulated, short-term home equity lending solutions. Speak with us today, and let’s work together to turn that “no” into a “yes.”

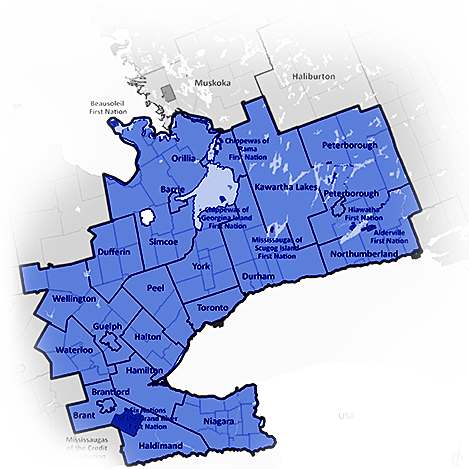

Where we lend

We fund first and second mortgages on single-family, multi-family homes, and select commercial properties in the Greater Toronto Area (GTA) and urban markets across Southern Ontario with populations over 50,000. All properties are appraised by accredited professionals to ensure precise valuations.

What we offer

→ Easy, quick application process

→ Respectful, reasonable underwriting

→ Approved funding in 2 to 5 business days

→ Up to 75% loan-to-value (LTV) ratio

→ Up to 12-month terms

→ Monthly interest-only payments

Designed with you in mind

Whether you’re self-employed, new to Canada, transitioning to a new home, or looking to refinance your mortgage, we’ve got the solutions you need. We understand the unique challenges of consolidating debt, funding home renovations, or navigating a career change, and our flexible mortgage options are tailored to help you achieve your goals. At every step, we’re here to provide support and guidance, making sure you get the right financial solution for your situation.

Self-employed

Entrepreneurs deserve the flexibility to access their home equity, but are often turned down by traditional banks. A key benefit of being self-employed is the ability to write off business expenses, but this can lower your reported income and make mortgage approvals difficult. At RAM, we accept self-declared income that reasonably reflects your actual earnings, giving you the opportunity to unlock your home equity with ease.

New to Canada

Newcomers to Canada are often eager for a fresh start, but building a new life can be challenging without an established credit history. This lack of credit can make borrowing difficult through traditional banks. At RAM, we focus primarily on the value of your property and the equity you’ve built, allowing us to approve mortgages more frequently than banks, regardless of your credit history.

Bridging to a new home

With a fast-approaching closing date and the challenge of carrying two properties, along with moving expenses, the process can feel overwhelming. A RAM mortgage offers the perfect bridge to help you secure your new home. Repay it easily once your current property is sold.

Refinancing mortgage

If you’re facing temporary financial challenges and can’t secure a renewal with a traditional bank, RAM offers bridge financing to help you through the transition. We provide the support you need until your financial situation improves.

Home renovations

Financing projects like a kitchen remodel or basement finishing often makes sense through your home equity. RAM’s short-term loans are perfect for funding renovations, especially when traditional banks decline. Unlock your home’s value and invest in its future.

Debt consolidation

Managing debts across various accounts, especially high-interest ones like credit cards, can be overwhelming and costly. With an RAM mortgage, you can consolidate your debts into one manageable payment at a lower, reasonable rate—helping you save money and simplify your finances.”

Job transition

Career transitions can make securing financing challenging. Whether there’s a gap between jobs or an unexpected expense arises, it can be difficult to get the funding you need. Banks may require several months of pay stubs before approving a loan. With RAM, you can access the financing you need to bridge the gap until you’re fully established in your new role.

Professional development

Taking a sabbatical or pursuing a one-year educational program is a valuable investment in your professional growth. However, it may require additional funding to cover expenses during your time away from work. We offer short-term loans secured by your home equity, giving you the financial freedom to take a ‘gap year’ and focus on advancing your career.

Four Steps to Funding

Application

Complete our Quick Funding application, telling us the estimated value of your property, your total current equity, and how much funding you need

Discussion

Expect a response within 24 hours to discuss your situation in more detail and explain next steps

Decision

Receive our underwriters’ decision within 5 business days with our offer and detailed terms

Funding

Move forward with your goals supported by your new funding

Contact

To apply, contact us directly. If you have a Mortgage Broker,

ask about RAM MIC mortgages.

info@ramgroupinternational.com | 647 828 2406

This website is to be used for general information purposes only. The information in this site does not constitute an offer to sell or a solicitation to invest in the Corporation. Investors should consult their own counsel and seek advice from a registered Financial Advisor or Dealing Representative before making an investment decision.

Contact Us

190 Millway Ave, Unit 1-B Vaughan, Ontario L4K 3W4 Canada