About MICs

The origin of MICs in Canada

In 1973, the Government of Canada enacted legislation to address a significant shortfall in mortgage funding nationwide. Due to rapid population growth and other contributing factors, there was an annual projected gap of $2.3 billion between the funds required and those available for residential and commercial real estate mortgages. As part of the government’s solution, a new financial instrument was introduced: the Mortgage Investment Corporation (MIC).

About MICs

Key Objectives Behind the Creation of MICs

Mortgage Investment Corporations (MICs) were created to meet two key objectives. First, they provide qualified borrowers, such as individuals and developers, with an alternative to traditional mortgages through a loan facility that offers less rigid terms and conditions than those typically imposed by financial institutions. Second, they offer private investors a secure and regulated way to invest in mortgage loans with terms ranging from 6 to 36 months, often at significantly higher rates than what most financial institutions provide.

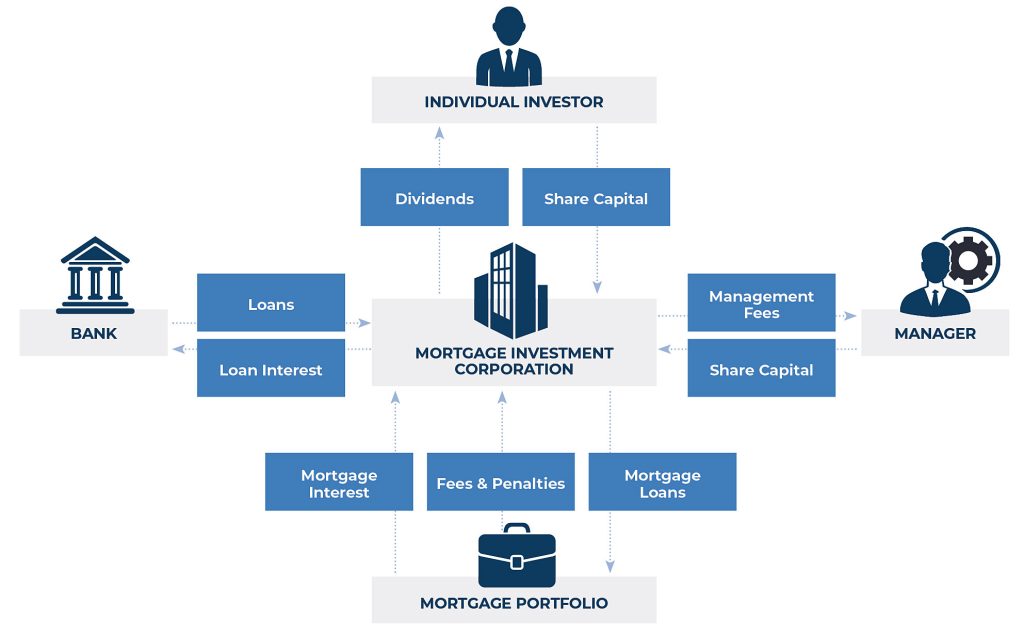

Today, MICs are well-established in Canada as investment and lending entities focused on mortgage lending. Investors pool their funds by purchasing shares in a MIC, which then lends those funds to borrowers who use their real estate as collateral.

MICs are governed by Section 130.1 of the Income Tax Act, which exempts them from corporate taxes and requires them to distribute all taxable income to shareholders as dividends. For tax purposes, these dividends are treated as interest income. Additionally, MIC shares qualify as eligible investments for RRSPs, RRIFs, DPSPs, RESPs, and TFSAs under the Income Tax Act.

How MICs are structured

Canadian MIC Structure

Requirements for qualifying as a Mortgage Investment Corporation (MIC) under the Canadian Tax Act

To qualify as a Mortgage Investment Corporation (MIC) under the Canadian Tax Act, several key requirements must be met. A MIC must have at least 20 shareholders, and no single shareholder can hold more than 25% of the corporation’s total capital. At least 50% of a MIC’s assets must consist of residential mortgages, cash, or insured deposits held at Canada Deposit Insurance Corporation member institutions.

All MIC investments must be made within Canada, although the MIC itself may accept investments from outside the country. A MIC is permitted to invest up to 25% of its assets directly in real estate but is prohibited from engaging in land development or construction activities.

As a flow-through investment vehicle, a MIC distributes 100% of its net income to shareholders. Dividends received on shares not held within registered plans are taxed as interest income. Additionally, a MIC’s annual financial statements must be audited, and it may use financial leverage by employing debt to partially fund its assets.

How MICs are managed

EFFICIENT MANAGEMENT AND COMPETITIVE FEES: HOW RAM DELIVERS VALUE TO MIC INVESTORS

The management team of a Mortgage Investment Corporation (MIC) oversees all aspects of its operations, including identifying suitable mortgage investments, evaluating mortgage applications, negotiating interest rates, terms, and conditions, coordinating with legal counsel, managing the mortgage portfolio, and handling general administration tasks.

Similar to an investment fund, the MIC’s management receives a fee, typically based on a percentage of assets under administration. RAM’s management fee, ranging from 0.5% to 1%, is among the lowest in the industry.

This website is to be used for general information purposes only. The information in this site does not constitute an offer to sell or a solicitation to invest in the Corporation. Investors should consult their own counsel and seek advice from a registered Financial Advisor or Dealing Representative before making an investment decision.

Contact Us

190 Millway Ave, Unit 1-B Vaughan, Ontario L4K 3W4 Canada